As we transfer further into 2025, one economical arena continues to be as aggressive and influential as ever: the hedge fund NYC scene. New York City proceeds to guide the global hedge fund marketplace, boasting a dense concentration of elite corporations, groundbreaking approaches, and several of the most formidable monetary expertise in the world. But with evolving industry forces, regulatory shifts, and technological disruption, navigating this landscape needs more Perception than in the past just before.

Right here’s what buyers, analysts, and finance industry experts ought to know about the point out of hedge cash in NYC right now.

Why NYC Is Still the Hedge Fund Epicenter

Ny city is property to numerous hedge funds running trillions in combined belongings. From Midtown Manhattan workplaces to distant quants working in Brooklyn lofts, the hedge fund NYC culture thrives on innovation, velocity, and worldwide market connectivity.

Town’s proximity to Wall Road, monetary media, major educational establishments, and deep-pocketed traders makes it the all-natural headquarters for many of the earth’s most influential money. Increase in a robust regulatory framework, unmatched entry to cash, plus a network of strategic associates — and it’s no wonder NYC remains the nerve Heart in the hedge fund world.

Dominant Tendencies Defining the Hedge Fund NYC Scene

In 2025, a number of vital tendencies are shaping the way hedge resources function in Big apple:

one. Quantitative and Algorithmic Methods

Quant resources dominate the fashionable hedge fund NYC market. Companies like Two Sigma, D.E. Shaw, and Renaissance Technologies use significant-driven products to interpret extensive amounts of facts and execute trades more quickly than humanly possible. Synthetic intelligence and machine Mastering are no longer differentiators — they’re necessary equipment.

two. ESG Integration

Environmental, Social, and Governance issues are front and center. Buyers now need not merely returns, but sustainable functionality. NYC-based hedge cash are responding by incorporating ESG metrics into their designs — from carbon footprint evaluations to range indexes.

3. World Macro and Geopolitical Positioning

With worldwide volatility rising, macro-targeted hedge resources are getting floor. Ny corporations are having to pay shut focus to geopolitical threats in Europe, Asia, and the Middle East, earning dynamic shifts in currency, commodity, and fairness exposure as gatherings unfold.

4. Hybrid Constructions and Private Funds

The trendy hedge fund NYC design isn’t restricted to public markets. Many are branching into non-public equity, undertaking capital, and personal credit history. This hybrid technique allows diversify threat and Strengthen returns although supplying money use of lengthier-expression, strategic performs.

Who’s Major the Pack?

A lot of the most productive gamers within the hedge fund NYC entire world in 2025 include:

Millennium Management – Noted for its multi-manager design and wide diversification.

Point72 Asset Management – Leveraging both equally discretionary and systematic approaches.

3rd Issue LLC – An extended-time activist powerhouse that continues to form boardrooms.

Two Sigma – The poster boy or girl for tech-meets-finance from the hedge fund space.

Citadel – However Chicago-centered, its NYC operations continue to be Main to its international dominance.

These companies aren’t just surviving — they’re location new requirements in effectiveness, innovation, and agility.

Opportunities for Traders in 2025

For people seeking to allocate funds, the hedge fund NYC scene features each possibility and complexity. Though conventional fairness strategies are generating a comeback amid sector volatility, numerous cash are featuring customized autos that align with Trader goals — regardless of whether it’s alpha technology, risk safety, or thematic publicity.

Homework remains crucial. Observe documents, risk metrics, group composition, and approach clarity are all extra important than see it here ever before in a very crowded Market.

Key Factors Ahead of Moving into the Hedge Fund NYC Market

Accessibility is restricted: Quite a few major-carrying out NYC hedge money are shut to new buyers or have exceptionally high minimums.

Transparency varies: Even though regulatory force has amplified openness, some funds stay notoriously opaque.

Volatility is typical: Hedge cash purpose for absolute returns, but quick-term volatility continues to be popular — especially in aggressive techniques.

Supervisor pedigree issues: The standard and regularity of the hedge fund’s leadership team frequently indicators foreseeable future results.

Remaining Views

The hedge fund NYC atmosphere in 2025 is the two fiercely competitive and stuffed with probable. The corporations that dominate are leveraging details, expanding globally, managing danger intelligently, and aligning with investor expectations in techniques that might are unimaginable just ten years back.

Irrespective of whether you’re an institutional Trader trying to get alpha, a financial Expert navigating your subsequent profession transfer, or an outsider seeking in, comprehension the terrain on the NYC hedge fund scene is essential. This is when fiscal innovation is born — and wherever fortunes are created

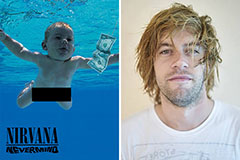

Spencer Elden Then & Now!

Spencer Elden Then & Now! Taran Noah Smith Then & Now!

Taran Noah Smith Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Marcus Jordan Then & Now!

Marcus Jordan Then & Now! Stephen Hawking Then & Now!

Stephen Hawking Then & Now!